Institutional-Grade Data for Every Asset

Value thousands of properties in minutes, not weeks. Benchmark holdings against live market data, quantify concentration risk, and flag ESG exposure — all from a single API.

BUILT FOR INSTITUTIONAL DECISIONS

REITs & Investment Funds

Benchmark portfolio performance against live market data. Identify under-performing assets and rebalancing opportunities at the click of an API call.

Lenders & Credit Risk Teams

Assess collateral exposure across your mortgage book with current valuations and market liquidity for every underlying property.

Family Offices & Wealth Managers

Deliver transparent, data-driven reporting on real estate holdings to HNW clients with always-current property metrics.

Developers & Promoters

Run quick go/no-go feasibility checks on new projects — analyze the market, compare pricing, and assess demand in minutes.

WHAT YOU CAN BUILD

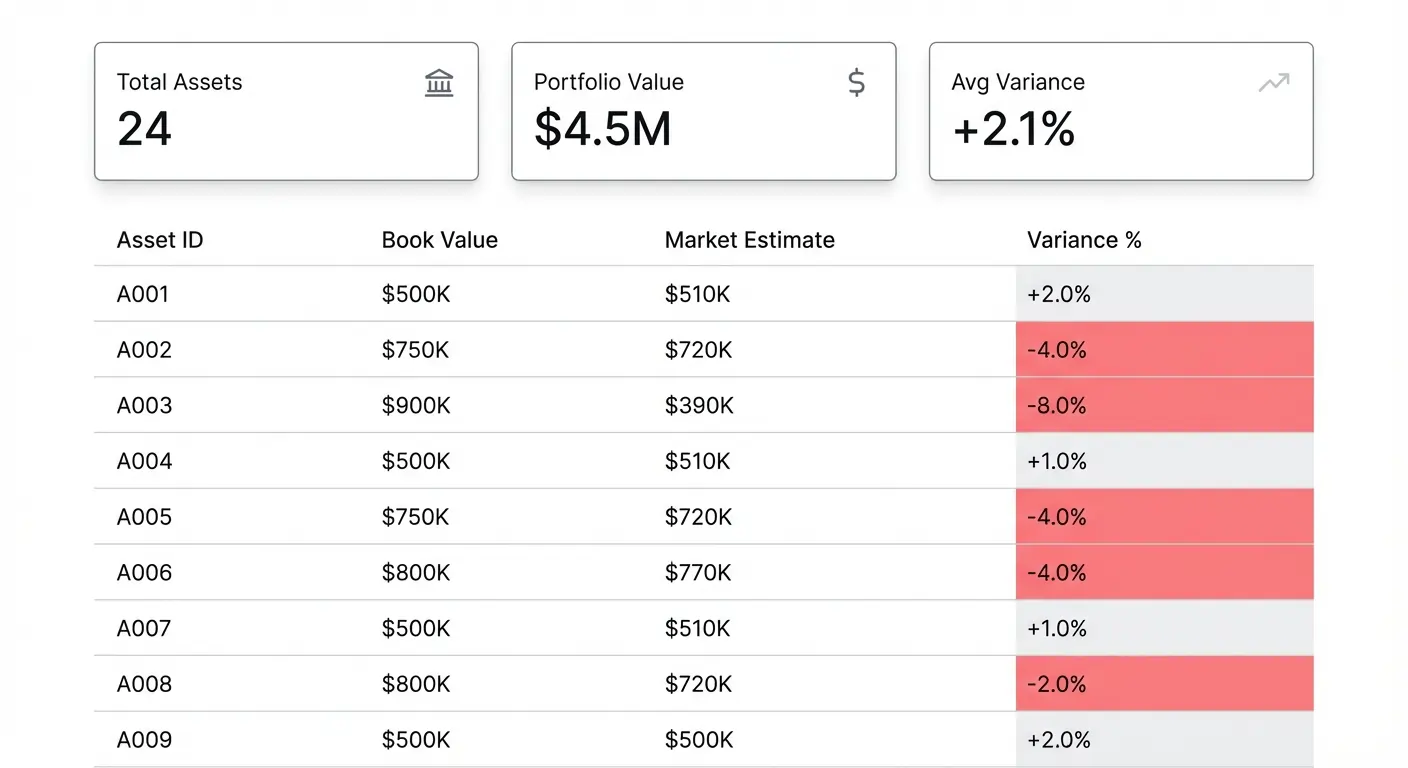

Portfolio Valuation Dashboard

Value hundreds of assets in a single API call. Display each property's current market estimate alongside its book value, and highlight variance — so portfolio managers spot over- and under-valued holdings instantly.

Risk & ESG Monitoring Console

Track energy performance ratings, renovation exposure, and regulatory risk across your entire portfolio. Flag assets with poor DPE scores or located in tightening regulatory zones before they become liabilities.

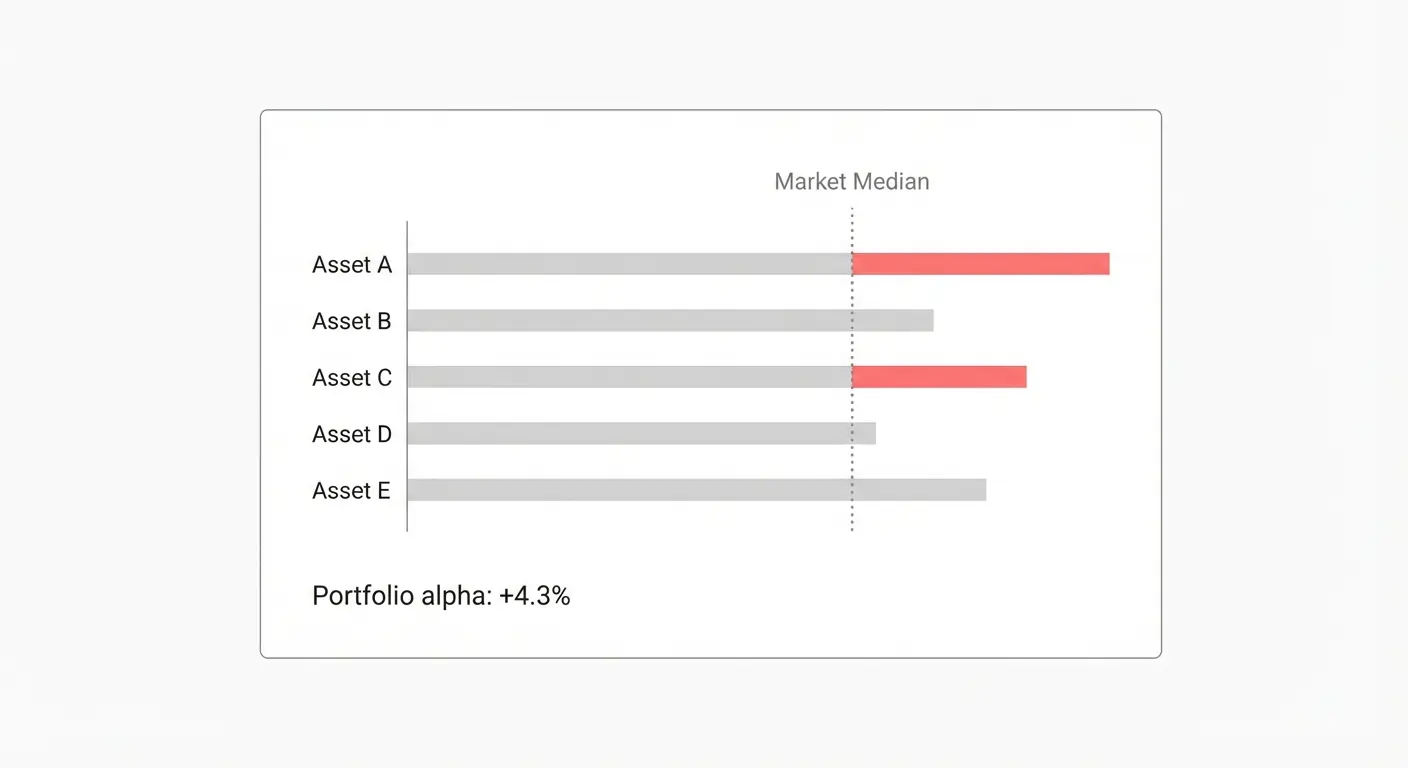

Asset Benchmarking Tool

Compare each asset's price/sqm against the live local market median. Detect outliers, measure portfolio alpha, and generate variance reports that fuel investment committee decisions.

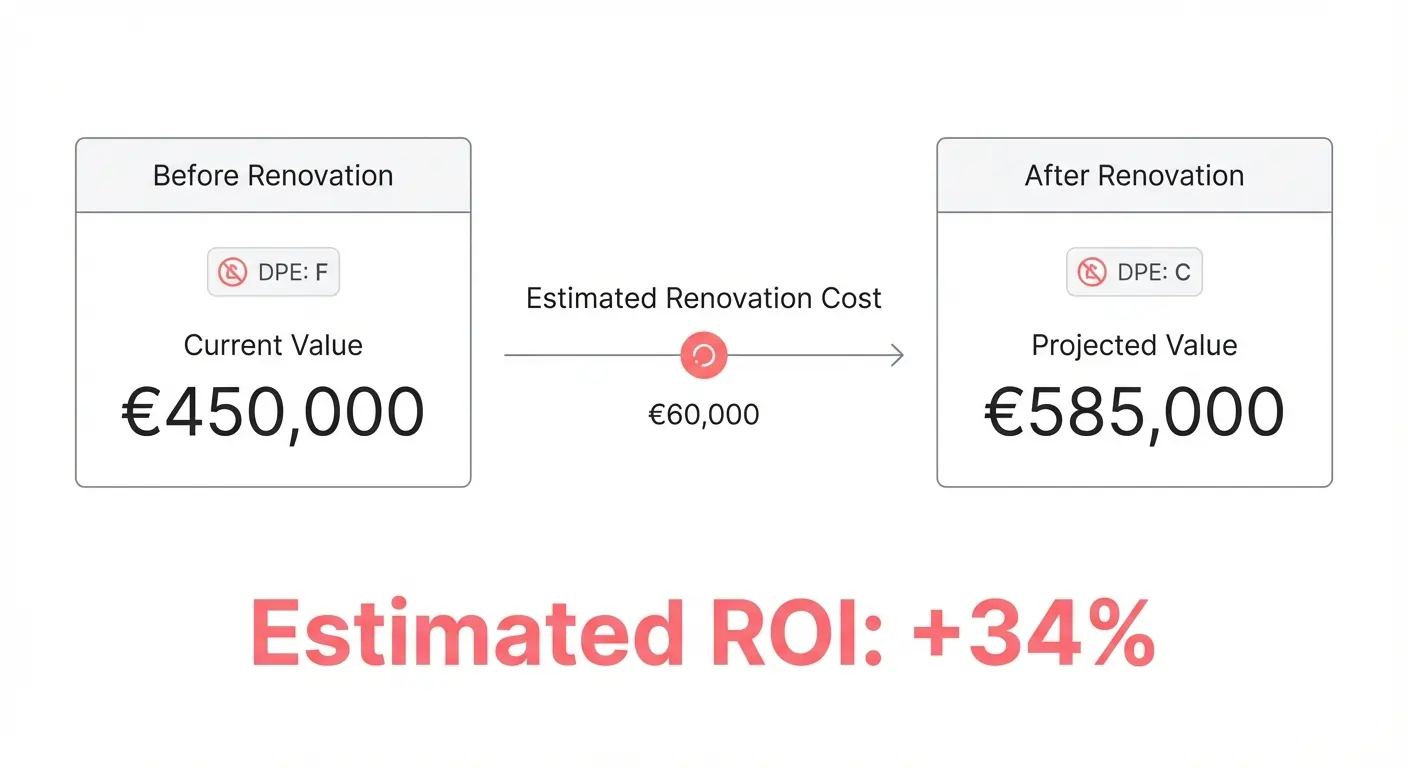

Renovation ROI Simulator

Model the impact of energy upgrades on asset value. Estimate how improving a DPE rating from F to C affects market price using real comparable data — and calculate the ROI on renovation spend before committing capital.

INTEGRATE IN MINUTES

The Full Picture for Every Asset

From transaction history to neighborhood demographics, get the depth required for institutional-grade portfolio analytics.